3-year Plan of Medium-term Business Results

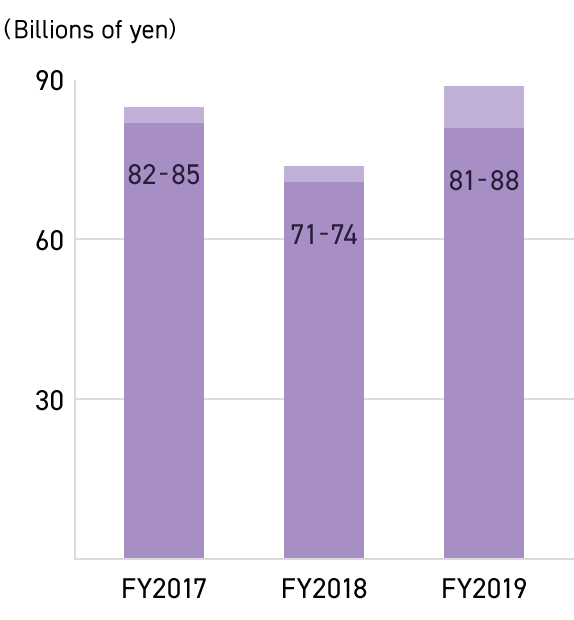

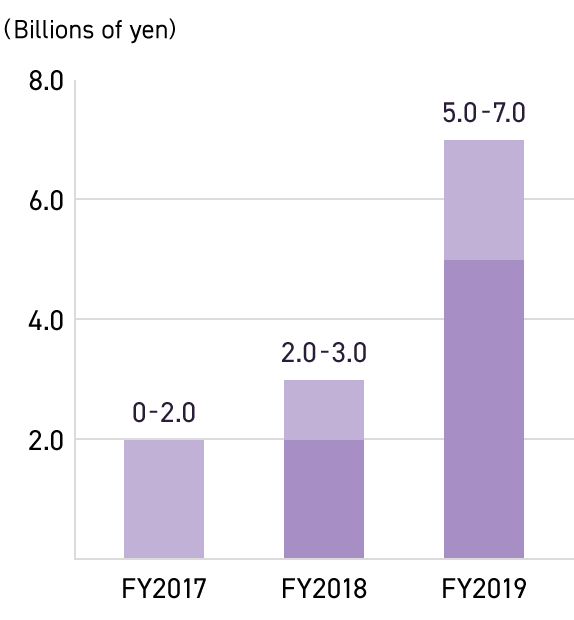

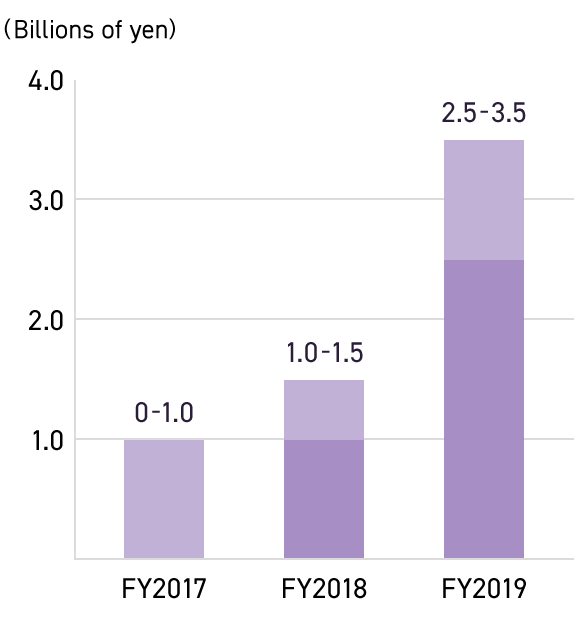

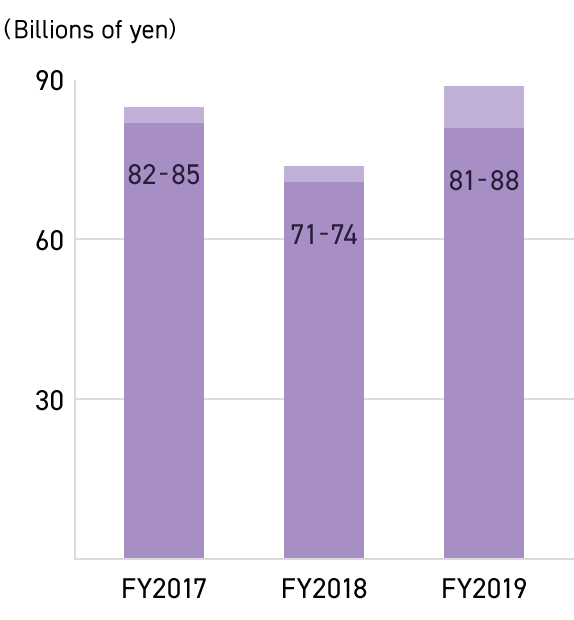

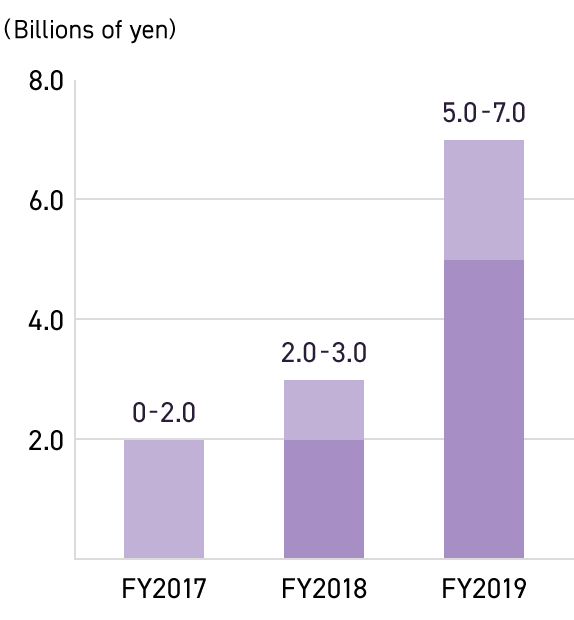

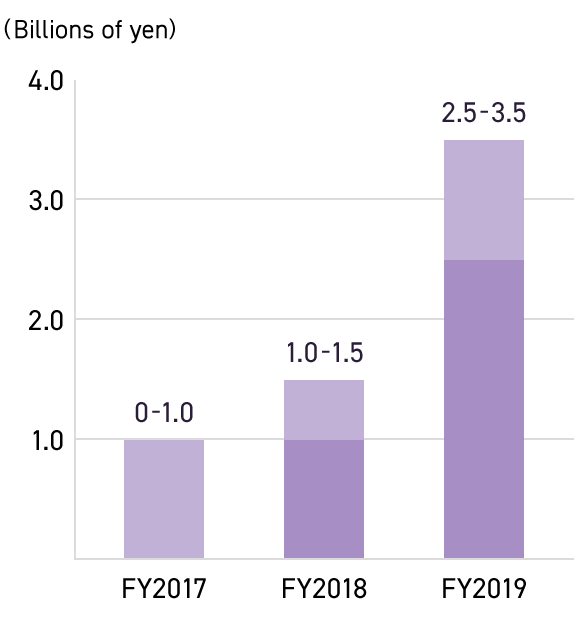

In fiscal 2017, the Group will concentrate on business activities focusing on strengthened earnings in the medium-term. The Group will also work to rebuild its business value chain, thoroughly strengthening the Company’s DNA—its planning and production capabilities—with an eye to the past and future of the market. In addition, the Group will promote efforts to evolve a business model aimed at maximizing its earnings from both IP and business platform perspectives. Consequently, according to our plan, our results forecast is ¥82–85 billion in net sales, ¥0–2 billion in ordinary income, and ¥0–1 billion in net income attributable to owners of parent. However, there are some uncertain elements such as the market environment in the pachinko and pachislot field, which is the Group’s core field of business, so figures have been given as a range of values. Furthermore, in this profit plan, we take into consideration risks in the process of advancing the selection and concentration of business and management efficiency with a medium-term perspective.

Our planned results outlook for fiscal 2018 is for ¥71–74 billion in net sales, ¥2–3 billion in ordinary income, and ¥1–1.5 billion in net income attributable to owners of parent. Net sales are forecasted to decrease compared with the previous fiscal year due to the impact of the sales mix* in the pachinko and pachislot machine business, however, ordinary income is expected to rise compared with the previous fiscal year owing to the effect of ongoing management optimization as well as the expected contribution from the pachinko and pachislot, and cross-media businesses.

Our planned results outlook for fiscal 2019 is for ¥81–88 billion in net sales, ¥5–7 billion in ordinary income, and ¥2.5–3.5 billion in net income attributable to owners of parent. In the pachinko and pachislot business, we will further evolve our product lineup and sales structure, while in the cross-media business, we will expand customer contact points in Japan and abroad. Consequently, we aim for conditions that will see further gains in net sales and ordinary income. We envisage that the pachinko and pachislot business will represent 70% of profit and the cross-media business will represent 30% of profit in this fiscal year.

- Net sales

- Ordinary income

- Net income attributable to owners of parent

- (Table 1) Medium-term performance plan

-

(Unit: billions of yen)

|

FY2016 |

FY2017 |

FY2018 |

FY2019 |

| Net sales |

76.6 |

82.0–85.0(+5.4–+8.4) |

71.0–74.0(-14.0–-8.0) |

81.0–88.0(+7.0–+17.0) |

| Operating income |

(5.3) |

1.0–2.0(+6.3–+7.3) |

2.0–3.0(0–+2.0) |

5.0–7.0(+2.0–+5.0) |

| Ordinary income |

(9.0) |

0–2.0(+9.0–+11.0) |

2.0–3.0(0–+3.0) |

5.0–7.0(+2.0–+5.0) |

| Net income attributable to owners of parent |

(12.4) |

0–1.0(+12.4–+13.4) |

1.0–1.5(0–+1.5) |

2.5–3.5(+1.0–+2.5) |

*Figures in parentheses show year-on-year fluctuations

*Progress in relation to the Medium-term Management Plan is available at Account Disclosure Materials.