“Establishing the Tsuburaya brand in China and the ASEAN regions”

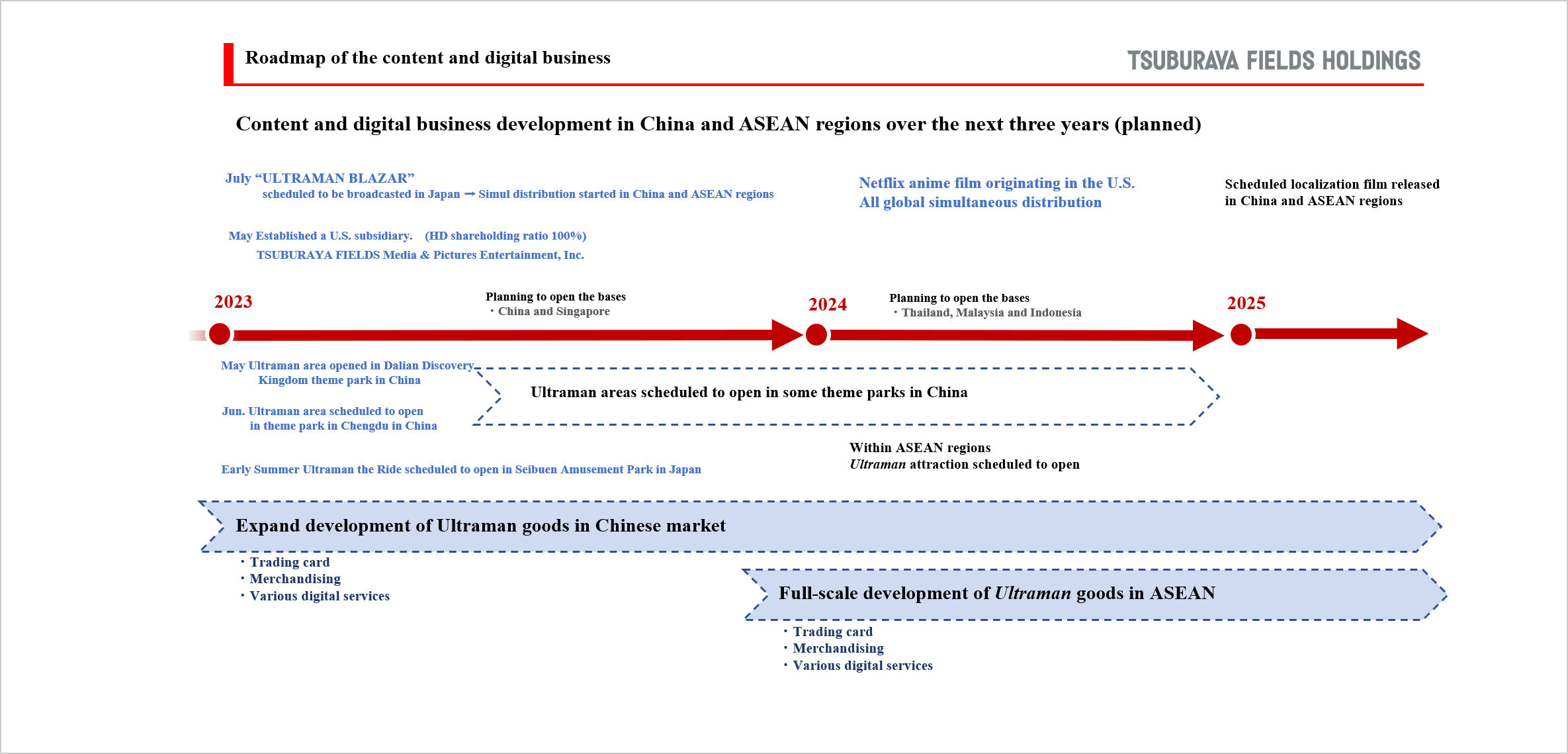

In order to establish the Tsuburaya brand in China and the ASEAN regions over the next three years, we will first build a robust cooperative structure with global business partners. By the end of the year, we want to establish overseas bases in China and Singapore, and next year, we want to also establish bases in Indonesia, Malaysia, and Thailand. In collaboration with our partners, first of all, in order to increase access to Ultraman, we will effectively expand into visual products and theme parks, and establish the Tsuburaya brand while developing merchandise in line with local cultures.

“Development of theme park”

In China, Ultraman area in Shanghai Haichang Ocean Park, which opened last year, is very strong. This was followed by the opening of a new Ultraman area within Dalian Discovery Kingdom theme park, China, in May 2023, which was larger than the one in Shanghai, and the number of visitors on the day of the opening also greatly exceeded the target. In June, we plan to roll out to a national theme park in Chengdu, China. By the end of the fiscal year, we plan to roll out to about two more locations, bringing total to around 10 locations by the final year of the medium-term management plan.

Ultraman has already gained overwhelming recognition and favorability, that enables us to develop in theme parks. In order to penetrate Ultraman brand, we will provide many touchpoints for Ultraman, not just in theme parks.

The development of visual products and theme parks, as well as merchandise on display at shops, is one of the touch points, and we will develop these touch points comprehensively.

Within Japan, we will open Ultraman the Ride in early summer in Seibuen Amusement Park. Expansion into theme parks also differentiates from other IP. In our survey, Ultraman is by far more favorable in China than other IP. We will aim to further penetrate the brand by expanding touch points at theme parks, etc.

After seeing our success in China, we have been approached by a large number of companies in various Asian countries who wish to collaborate with us.

“Development of culturally appropriate products”

In China, merchandise business centered on trading card games, has been performing well, however the number of new licensees is increasing in other categories as well with steady growth in block toys and other products. In addition, we will implement a variety of initiatives in the future, including digital services. In ASEAN region, although still small, looking at successful cases in China, the number of new partners is increasing. And we will develop merchandise tailored to the cultures of each country.

“Development in North America”

In terms of expansion into North America, we established a subsidiary in the U.S. in May. In 2024, Ultraman’s CG anime film produced by Netflix will be distributed worldwide. We intend to proceed with preparations through subsidiaries for North American expansion in line with distribution and contribute firmly to earnings.